The Federal Treasurer announced a mid-year update on the state of our

national economy. While the update focused on Australia’s economic and

fiscal outlook, it built on a number of recent policy announcement relevant

to the private capital industry.

The key recent policy announcement relevant to the private capital industry

are:

- Extension of JobKeeper payments

by six months to 28 March 2021, including a two-tiered payment system to be introduced on 28 September to align the payment with employees’ pre-COVID

incomes;

- Jobs and Skills programs including additional low and no

fee training places for apprentices and school leavers and a higher

education relief package to help fill skills gaps;

- SME Guarantee Scheme to support up to $40 billion of

lending to SMEs, with loans up to $1 million; and

- Priority Infrastructure projects: 15 major

infrastructure projects will be fast-tracked and are estimated to be worth

$72 million in public and private sector investment.

Further details on these policies is provided below.

The key fiscal and economic updates provided by the Treasurer and Finance

Minister are:

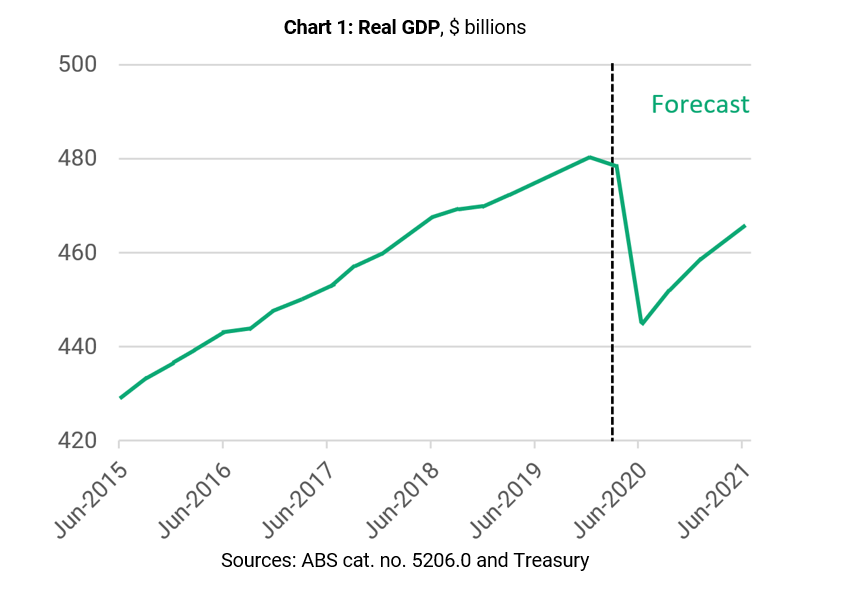

- Real GDP is expected to fall by 3.75 per cent in 2020

then grow by 2.5 per cent in 2021. A 7 per cent drop in real GDP is

expected in the June quarter. In contrast, global GDP is predicted to

contract by 4.75 per cent in 2020 then grow by 5 per cent in 2021;

-

$85.8 billion and $184.5 billion deficits are forecast for 2019-20 and

2020-21

, respectively. This is on the back of falls in tax receipts of $31.7

billion and $63.9 billion in 2019-20 and 2020-21, respectively, and the

$289 billion (14.6 per cent of GDP) government stimulus spending;

-

Net debt is expected to reach 24.6 per cent and 35.7 per cent of GDP in

2019-20 and 2020-21

, respectively. Australia’s new debt position remain significantly below

that of our major trading partners and the G20 average. Australia’s AAA credit rating has been reaffirmed by all

three major credit rating agencies; and

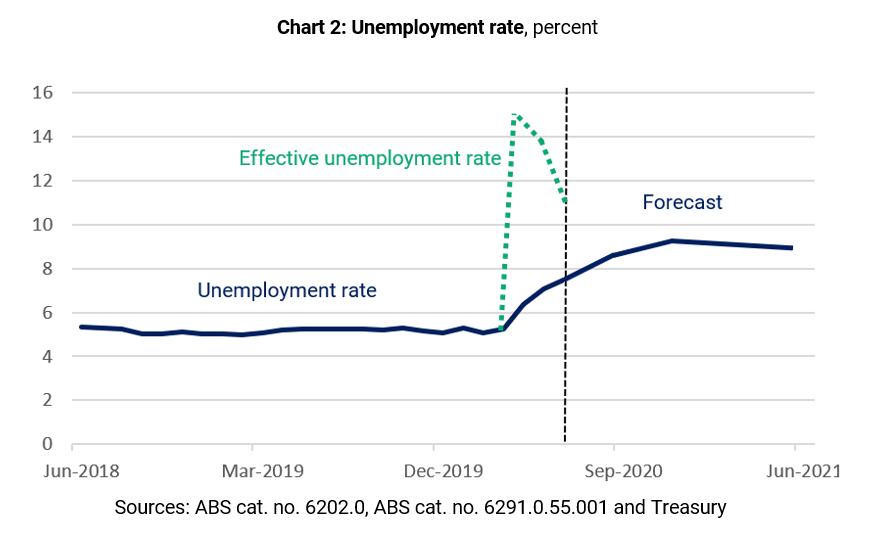

- Australia’s unemployment rate is expected to peak at 9.25 per cent.

The effective unemployment rate, which takes account reductions in working

hours and labour participation, reached almost 15 per cent in April 2020

and has started to fall, reaching almost 11 per cent in June 2020, buoyed

by an increased in working hours.

The Government will release its delayed Federal Budget in October this

year. The Council is preparing a pre-budget submission, which will build on

our recent advocacy work and political engagements, to reflect our

industry’s key priorities.

Extension of JobKeeper Payments

On 21 July, the government

announced

that JobKeeper would be extended by six months to 28 March 2021 and the

temporary Coronavirus Supplement for those on income support will be

extended until 31 December 2020.

From 28 September 2020, businesses, and not-for-profits will be required to

reassess their eligibility through their actual June and September quarter turnovers to demonstrate that they

have experienced an ongoing significant decline in turnover. Organisations will need to demonstrate the relevant decline in

turnover in both of those quarters to be eligible for the JobKeeper Payment

in the December quarter.

Employers will need to again reassess their eligibility for the JobKeeper

Payment for the March quarter. Employers will need to demonstrate that they

have met the relevant decline in actual turnover in each of the previous

three quarters ending on 31 December 2020 to remain eligible for the

JobKeeper Payment in the March quarter 2021.

If the turnover test in the extension period is not met, this does not

affect their eligibility prior to 28 September 2020. The continuation of

JobKeeper for eligible businesses is aimed to support the economic recovery

and provide them with sufficient time to adjust.

The JobKeeper Payment will continue to remain open to new participants that

meet the eligibility requirements.

A two-tiered payment will also be introduced from 28 September, to align

the payment with the incomes of employees before the onset of the COVID-19

pandemic. Employees who were employed for less than 20 hours a week on

average in the four weekly pay periods ending before 1 March 2020 will

receive the lower payment rate.

JobKeeper Payment rates from 28 September 2020 to 28 March 2021

|

Date

|

Full rate per fortnight

|

Less than 20hrs worked per fortnight

|

|

28 September 2020 to 3 January 2021

|

$1,200

|

$750

|

|

4 January 2021 to 28 March 2021

|

$1,000

|

$650

|

Expanding skills and creating jobs

On 16 July 2020, the Government

announced

a $2 billion skills package. The package includes:

- the establishment of a $1 billion JobTrainer Fund (jointly funded by state

and territory governments), to provide additional low and no fee training

places for job seekers and school leavers. The JobTrainer fund aims to

provide for around 340,700 additional training places to help school

leavers and job seekers; and

- an expansion of the Supporting Apprentices and Trainees wage subsidy for

a further 6 months to 31 March 2021 and also expanded to include

medium-sized businesses from 1 July 2020.

Eligibility has also been expanded. From 1 July 2020 to 31 March 2021, the

subsidy will be available for SMEs with fewer than 200 employees (up from

20 employees), including those using a Group Training Organisation. The

subsidy will still cover 20 per cent of the apprentice’s or trainee’s wage,

up to a cap of $7,000 per quarter.

Expansion of SME Guarantee Scheme

On 20 July 2020, the Government announced the

expansion

of the Coronavirus SME Guarantee scheme

.

Key changes to the Scheme include:

· Extending the purpose of loans able to be provided beyond working

capital, such that a wider range of investment can be funded;

· Permitting secured lending (excluding commercial or residential

property);

· Increasing the maximum loan size to $1 million (from $250,000) per

borrower;

· Increasing the maximum loan term to five years (from three years); and

· Allowing lenders the discretion to offer a repayment holiday period.

The initial phase of the Scheme remains available for new loans made by

participating lenders until 30 September 2020. The second phase of the

Scheme will start on 1 October 2020 and will be available for loans made

until 30 June 2021.

Priority infrastructure Projects

The Prime Minister recently

announced

that 15 major infrastructure projects would be fast-tracked under a

bilateral model between the Commonwealth, states and territories.

These projects are estimated to be worth more than $72 million in public

and private investment and include:

· Inland Rail from Melbourne to Brisbane;

· Marinus Link between Tasmania and Victoria;

· Olympic Dam extension in South Australia;

· Emergency town water projects in New South Wales; and

· Road, rail and iron ore projects in Western Australia.

The Government has committed to reduce assessment and halve approval times

for major products from an average of 3.5 years to 21 months.

Infrastructure is one of seven key policy areas imperative to reigniting

Australia’s economy which are identified in the Council’s recent

Roadmap to Recovery: Creating a Stronger and More Dynamic Economy

report.