Performance Highlights March 2020

-

Industry Snapshot:

The Australian private equity and venture capital (PE/VC) industry

remains significant, with $30 billion of capital raised to date. In the

first quarter of 2020, the industry continued to deploy capital into

Australian and New Zealand companies and distribute capital back to

investors. In aggregate over the 12-month period ending March 2020, the

industry invested $1.2 billion and distributed more than $1.2 billion,

net of fees, back to investors.

-

Strong Long-term Performance:

Australian PE/VC demonstrated strong long-term net of fees performance

for investors, with an uplift in outperformance versus the ASX 300 and

the ASX Small Ordinaries Index for the 5, 10, and 20-year periods

ending 31 March 2020 – tracking between +6.3% and +11.5% ahead of the

listed market. Long-term performance of the local market remains

broadly in-line with global peers over time.

-

Early Impacts of COVID-19:

Australian PE/VC market held-up well during the initial days of the

COVID-19 pandemic (as measured through 31 March 2020) relative to both

listed markets and global peers. PE/VC performance during this period

protected investor capital in a meaningful way. Over the one-year

ending March 2020, performance lagged global peers, primarily due to

market-specific factors, including a lower allocation to information

technology in the Australian PE/VC market.

Industry Snapshot

The Australian PE/VC index represents a well-established industry and a

significant pool of capital and net of fees strong distributions to

investors. At the end of Q1 2020, the Cambridge Associates Australian PE/VC

Index represented $29.4 billion of capital raised by 108 PE/VC funds. Over

the 20-year period of data captured by the Index, the industry has invested

$24.3 billion (+$596 million in Q1 2020) in Australian and New Zealand

companies, returning $27.6 billion (+$108 million in Q1 2020) net of fees

back to investors and still holding unrealised investments valued at $9.0

billion (-$116 million in Q1 2020). This universe is historically dominated

by buyout and growth equity strategies, representing 93% of total

capitalization, while venture capital funds represent 7% of the index by

capitalization. In the first quarter of 2020, buyout and growth equity

funds provided 61% of distributions to investors, while venture capital

funds accounted for 39% of distributions during the period. By net asset

value as at first quarter 2020, buyout and growth equity accounted for 83%

of the index, and with 17% in venture capital.

Over the one-year ending March 2020, the industry invested $1.2 billion

into Australian and New Zealand companies, in line with prior years, which

have averaged $1.3 billion per year (since 2009). Investors received net of

fees distributions of $1.2 billion from Australian PE/VC managers over the

one-year period, lower than the average $2.3 billion per year since 2016.

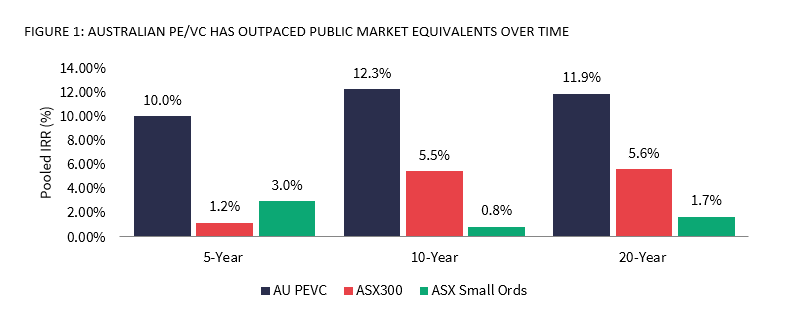

Long-Term Performance Remains Strong

As of end March 2020, the initial impacts of COVID-19 were only beginning

to be reflected in performance data. Over the long term, Australian PE and

VC returns showed continued strong long-term performance, delivering double

digit net of fees returns over 5-, 10-, and 20-year periods (Figure 1).

Over these same periods, Australian PE/VC managers in aggregate

demonstrated robust outperformance over the listed markets, outpacing the

ASX 300 Index by +6.3% to +8.8% and the ASX Small Ordinaries Indices by

+7.0% to +11.5% on a public market equivalent (mPME) basis. To measure

mPME, Cambridge Associates compares private equity performance to that of

listed equities by hypothetically ‘investing’ in the ASX 300 and the ASX

Small Ordinaries at the same time and equivalent amount as the private

equity investments. While it is generally accepted that the higher risk and

illiquidity of private equity require it to generate returns of +3% to +5%

over listed markets over time, the local PE and VC industry surpasses this

standard hurdle. It has also benefited from limited downside movement

versus listed markets in the recent quarter and over time.

Source: Cambridge Associates Database, 31 March 2020, net of fees, expenses and carried interest. Returns presented in Australian Dollar terms.

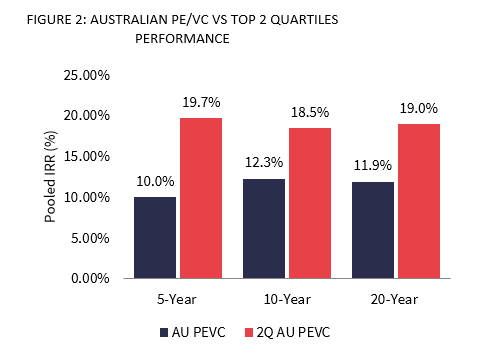

Manager selection and the ability to access top performing managers

provided even greater absolute return net of fees and relative to the

listed markets. In the data gathered by Cambridge Associates, the top two

quartiles of Australian PE/VC funds have delivered 18%+ annualised returns

over 5-, 10-, and 20-year periods ending 31 March 2020 (19.7%, 18.5%, and

19.0% respectively net of fees and carried interest, see Figure 2). This

universe exceeds returns of the broad Australian PE/VC industry by +6.5% to

+11.7% per annum over time, while also outperforming the ASX 300 Index by

+13.8% to +18.4% and the ASX Small Ordinaries Index by +16.7% to +18.0% on

a public market equivalent (mPME) basis.

Source: Cambridge Associates Database, 31 March 2020, net of fees, expenses and carried interest. Returns presented in Australian Dollar terms.

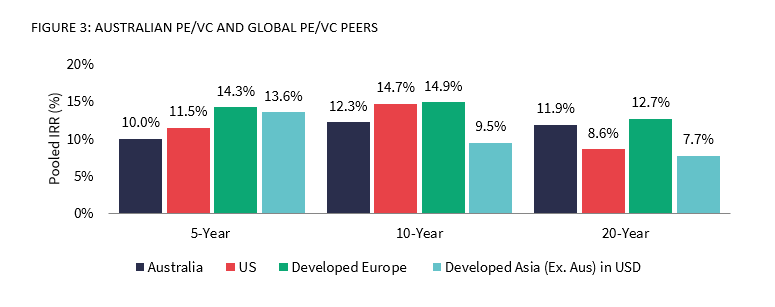

Australian PE/VC performance remains competitive among global peers over

time. On a local currency basis, with each region measured in its base

currency unless noted otherwise, Australian PE/VC returns exceed US and

Asian PE/VC peers and lag European PE/VC over 20 years (Figure 3). Over 5-

and 10-year periods, Australian performance lags global PE/VC, reflecting

local market factors including interest rates, valuations and in some

instances market depth and the impact of sector exposures.

Source: Cambridge Associates Database, 31 March 2020, net of fees, expenses and carried interest. Returns presented in local currency terms.

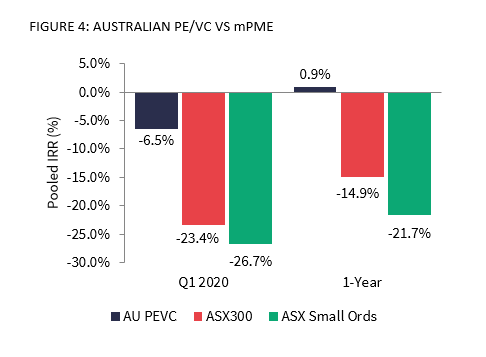

Early Impacts of COVID-19

Just as COVID-19 has had an extraordinary impact on the lives and

livelihoods of Australian citizens, so too has it impacted financial

markets. Public markets felt the impact of COVID-19 in the first quarter,

reaching lows in mid-to-late March. Over this time, the Cambridge

Associates Australian PE/VC Index declined by -6.5%, a limited downside for

investors relative to listed markets during the quarter. The Australian

PE/VC industry performance bested listed markets (Figure 4) by nearly 17%,

and 16% for the first quarter and one-year ending March 2020, respectively.

A quarterly return of -6.5% for Australian PE/VC represents the largest

negative quarterly return for the industry since December 2008, and one of

six quarters with a negative return during that 45-quarter period. For the

12 months ending 31 March 2020, the Australian PE/VC industry outpaced the

ASX 300 Index and the ASX Small Ordinaries Index by +15.8% and +22.6%

respectively.

Source: Cambridge Associates Database, 31 March 2020, net of fees, expenses and carried interest. Returns presented in Australian Dollar terms.

While it is useful to measuring the industry cash flows over a quarterly or

12-month period to provide a snapshot of the recent market volatility, this

periodicity does not provide a meaningful performance indicator for a

long-term asset class. Private equity and venture capital performance is

measured over the medium to long-term (5- to 20-year periods) to align

performance with the strategy of acquiring and divesting investment assets.

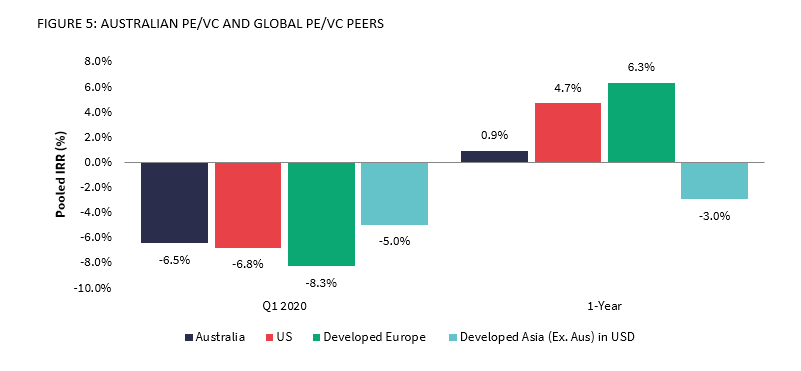

Australian PE/VC performed in line with global developed PE/VC markets, in

local currency terms during the first quarter (Figure 5). However,

Australian PE/VC lagged global peers over 1-year ending March 2020, similar

to the 5- and 10- year periods referenced above. In the one-year period,

Australian PE/VC had significantly lower allocations to Information

Technology relative to global peers which benefitted from the sectors

strong performance.

Source: Cambridge Associates Database, 31 March 2020, net of fees, expenses and carried interest. Returns presented in local currency terms.

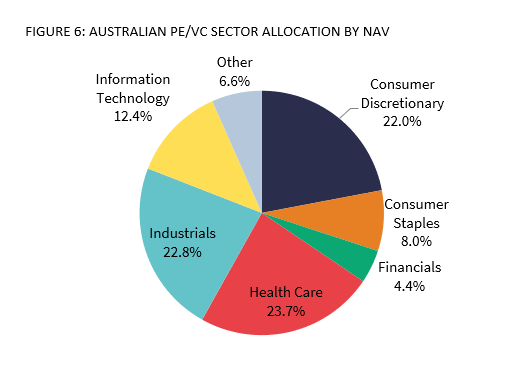

Since its inception, over 80% of returns from the industry have been driven

by investments in four sectors: consumer, industrials, healthcare, and IT.

While the ASX 300 has been dominated by financials and materials, private

equity has offered investors differentiated sector exposure and investments

outside publicly listed companies. At the end of March 2020, the Australian

PE/VC index continued to be dominated by the four key sectors noted below

(Figure 6).

Source: Cambridge Associates Database, 31 March 2020.

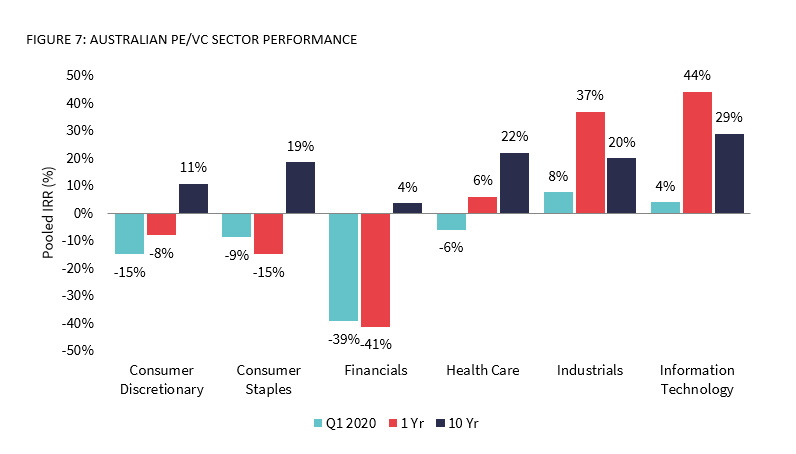

The -6.5% first quarter return of the Australian PE/VC index incorporates

the quarterly movements of key sector allocations (Figure 7). Consumer

discretionary and financials saw a significant impact on valuation in the

early stages of the consumer crisis, with healthcare impacted by initial

COVID-19 lockdowns. Downside during the quarter was mitigated by

performance of industrials and IT. Over the long-term (10-year), these key

sectors added value to the PE/VC index performance.

Source: Cambridge Associates Database, 31 March 2020, net of fees, expenses and carried interest. Returns presented in Australian Dollar terms.

Australian PE/VC Looking Ahead

PE and VC managers were quick to respond, intensively and actively working

with their portfolio companies to dampen the initial impacts of the global

pandemic and access available support from governments and banks. However,

the net effect of these industry efforts in aggregate will only build over

time with ongoing performance data. As additional data builds via the

Australian PE/VC Index, Cambridge Associates will continue to measure the

PE/VC industry and reflect on the impacts to valuation, distributions and

investments in Australia and New Zealand.