Highlights

-

Stable Industry Continues to Grow:

The Australian private equity and venture capital (PE/VC) industry is

significant, with $30.3 billion of capital raised to date. The industry

continued to deploy capital into Australian and New Zealand companies

and distribute capital back to investors. In aggregate for the year

ending December 2021, the industry invested approximately $1.1 billion

and distributed more than $2.4 billion, net of fees, back to investors,

while the value of unrealized investments increased by $5.2 billion. By

net asset value as of 31 December 2021, buyout and growth equity

accounted for 64% of the index, with 36% in venture capital.

-

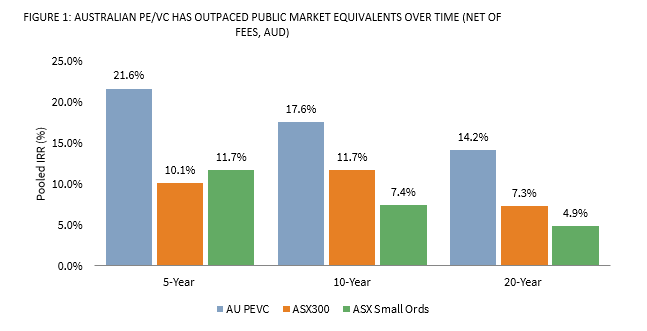

Strong Long-term Performance:

Australian PE/VC continues to demonstrate strong long-term net of fees

performance for investors, outpacing the ASX 300 and the ASX Small

Ordinaries for the 5, 10, and 20-year periods ending 31 December

2021—tracking between +5.9% and +11.5% ahead of the listed markets.

Long-term performance of the local market remained in line with global

peers.

-

Performance Snapshot:

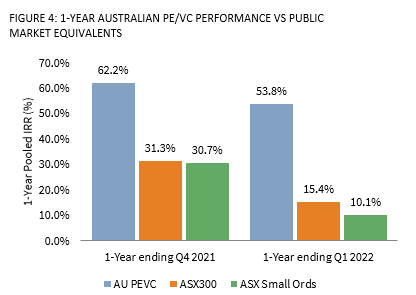

Australian PE/VC delivered remarkable performance in 2021, with the

industry up +62.2% net of fees for the year ending December 2021. A

dramatic uplift in unrealized net asset value contributed to the

strongest one-year net IRR in 20 years. While public markets ended 2021

at historic highs, the downturn in public markets was a forward

indicator of PE/C returns heading into 2022. In Q1 2022 the industry

saw muted returns for the quarter. Australian PE/VC trailing 1-year

returns outpaced public markets equivalents and global peers, while

global macro factors outweighed the pandemic tailwinds.

-

Looking Ahead:

Trends present at the onset of 2022 – rising inflation, rising interest

rates and geopolitical instability and supply chain issues aggravated

by the Russian invasion of Ukraine – will continue to impact public and

private markets as the year unfolds. Historical performance in

Australian PE/VC remains strong, further enhanced by the notable 2021

returns. Realized returns are influenced by these multi-faceted impacts

along the way. For Australian PE/VC performance, manager value add will

be increasingly important amid influences from the economy, inflation,

interest rates, and public markets.

Long-Term Performance Remains Strong

Over longer periods, Australian PE and VC returns showed continued strong

long-term performance, delivering double digit net of fees returns over 5-,

10-, and 20-year periods (Figure 1). To measure mPME, Cambridge Associates

compared private equity performance to that of listed equities by

hypothetically ‘investing’ in the ASX 300 and the ASX Small Ordinaries at

the same time and equivalent amount as the private equity investments.

While it is generally accepted that the higher risk and illiquidity of

private equity require it to generate returns of +3% to +5% over listed

markets over time, the local PE and VC index has achieved this standard

hurdle across periods.

Source: Cambridge Associates Database, 31 December 2021, net of fees, expenses and carried interest. Returns presented in Australian Dollar terms.

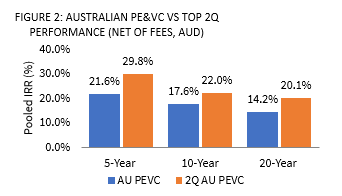

Manager selection and the ability to access top performing managers

provided higher absolute returns net of fees and relative to the listed

markets. In the data gathered by Cambridge Associates, the top two

quartiles of Australian PE/VC funds exceeded returns of the broader

Australian PE/VC industry by +4.5% to +8.2% per annum over time, while also

outperforming the ASX 300 Index by +10.4% to +19.7% and the ASX Small

Ordinaries Index by +14.6% to +18.1% on a public market equivalent (mPME)

basis.

Source: Cambridge Associates Database, 31 December 2021, net of fees, expenses, and carried interest. Returns presented in Australian Dollar terms.

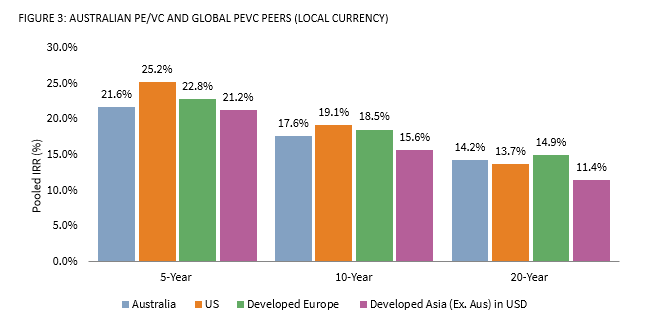

On a local currency basis, with each region measured in its base currency

unless noted otherwise, Australian PE/VC returns exceeded US and Asian

PE/VC peers while in line with European PE/VC over the 20-year period

(Figure 3). Over 5- and 10-year periods, Australian performance lagged US

and European PE/VC while outperforming Developed Asia PE/VC, reflecting

local market factors including interest rates, valuations, market depth and

sector exposures.

Source: Cambridge Associates Database, 31 December 2021, net of fees, expenses and carried interest. Returns presented in local currency terms.

A Year in Review

The Australian PE/VC Index was up a notable +62.2% for 2021, outperforming

the ASX 300 and ASX Small Ordinaries by 30.9% and by 31.5%, respectively

(Figure 4). The start of 2022 delivered more subdued performance. The

Australian PE/VC index had a pooled return of 0.2% in the first quarter –

the lowest quarterly return for the index since the start of the COVID-19

Pandemic (-6.5% for first quarter 2020). Australian PE/VC continued to

outpace its listed market equivalents for the trailing 1-year ending 31

March 2022, extending the outperformance relative to listed markets to

+38.5% and +43.7%, respectively.

Source: Cambridge Associates Database, 31 March 2022, net of fees, expenses, and carried interest. Returns presented in Australian Dollar terms.

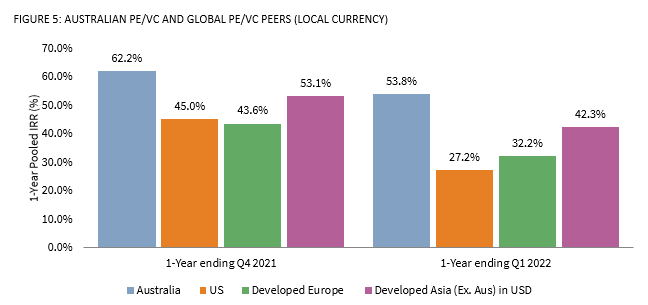

Australian PE/VC provided the strongest trailing 1-Year performance

relative to global peers (in local currency) for periods ending 31 December

2021 and 31 March 2021 (Figure 5). In 2021, Australian PE/VC performance

was driven by an uplift in net asset value relative to global peers, while

returns of global peers included increases in net to LP distributions as

well as a more modest uplift in net asset values. In the first quarter of

2022, Australian PE/VC’s quarterly pooled net IRR of 0.2% held up better

than that of global peers in local currency. Strong net to LP distributions

and a steady NAV underwrote Australian PE/VC returns in Q1 2022, while the

pooled quarterly return of global peers was impacted by negative

adjustments to NAV and low levels of distributions.

Source: Cambridge Associates Database, 31 March 2022, net of fees, expenses and carried interest. Returns presented in local currency terms.

While it is useful to measure the industry’s cash flows over a quarterly or

12-month period to provide a snapshot of recent market volatility, this

periodicity does not provide a meaningful performance indicator for a

long-term asset class. Private equity and venture capital performance is

measured over the medium to long-term (5- to 20-year periods) to align

performance with the strategy of acquiring and divesting investment assets.

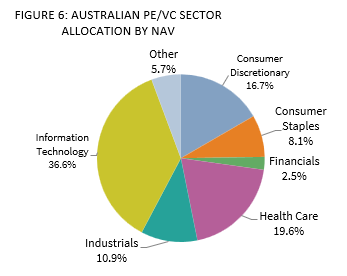

As of 31 March 2022, the Australian PE/VC index continued to be dominated

by four key sectors: IT, Consumer, Healthcare, and Industrials (Figure 6).

In Q1 2022, the Australian PE/VC Index invested capital into Industrials,

Consumer Discretionary, and IT companies and realizations came from

companies in the Healthcare, Industrials, and Consumer Discretionary

sectors.

Source: Cambridge Associates Database, 31 March 2022, gross of fees, expenses and carried interest. Other includes Communications Services, Energy, Materials, Real Estate, and Utilities.

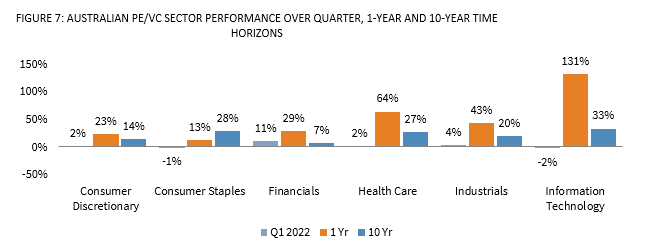

Australian PE/VC Index sector “winners” for 2021 included: IT, Consumer

Staples, Healthcare, and Industrials, and performance in the IT sector

dominated the trailing 1-year returns. Financials continued to make modest

gains during the period, though trails strong performance of the broader

index. In Q1 2022, IT and Consumer Staples lagged the other sector returns,

while Financials showed the strongest performance. While this quarterly

update provides a reference to PE/VC performance during the period, it is a

very short time frame of data for strategies that typically manage

investments with a three- to seven-year holding period.

Source: Cambridge Associates Database, 31 March 2022, gross of fees, expenses and carried interest. Returns presented in Australian Dollar terms.