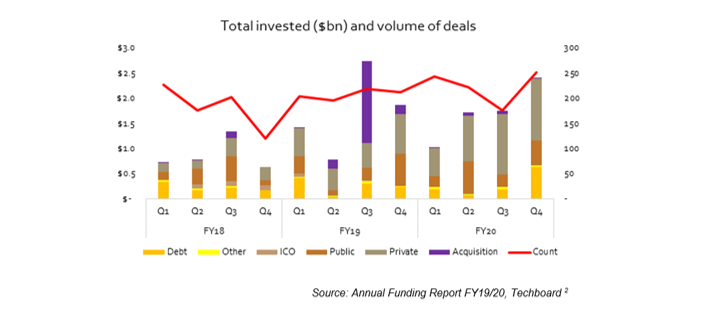

During the early days of the economic contraction triggered by COVID-19,

global reporting indicated significant slowdowns in venture capital (VC)

funding, with falls recorded across China, Europe and the US in the third

quarter or FY20.1 Techboard data has not shown the same contraction in

Australia. While the number of recorded funding events dropped during the

third quarter of the financial year, total funding appeared to plateau and

then increase in the last quarter to its highest level ever recorded

(excluding the $1.6bn PEXA (Property Exchange Australia) acquisition), with

$2.4bn funded in the three months to June 2020.

However, the number of private deals at the lower end of the scale (sub

$5mn) contracted during Q3 with a recovery in deals from $1-$5mn in Q4 and

sub $1mn deals continuing to decline in Q4.

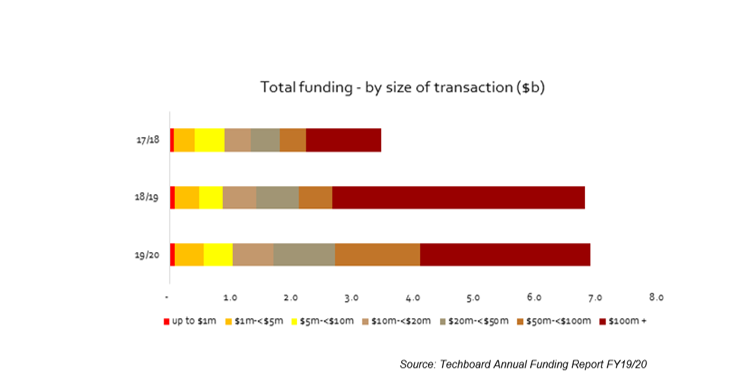

Total reported startup funding from all sources (private, public, grants,

crowdfunding, accelerators and acquisitions) during the 2020 financial year

was $6.9 bn. This total is in line with the previous year’s $6.8 bn, but

almost double the $3.5 bn reported in FY18. Private investment levels,

however, moved markedly from 2019 from $2.26bn to $4.48bn, with the number

of private investments captured rising by 23% to 377 deals.

This is a strong performance for a year significantly impacted in its

second half by a global pandemic and unfolding economic contraction. The

Australian venture capital markets appear to have weathered the COVID-19

storm well – at least initially, though other funding sources (such as

public markets) perhaps less well.

The funding data collected by Techboard over the past three years suggests

a maturing of the startup and tech sector in Australia, with funding events

generally getting larger as companies are maturing.

In particular, between FY18 and FY19 there was a marked uptick in funding

events greater than $100mn, up 167% in quantity and 235% in value. Funding

events of all sizes increased year-on-year between FY18 and FY19, with the

exception of deals in the $5mn-$10mn range. From FY19 to FY20, funding

events again increased year-on-year in all categories, including in the

$100mn+ range when the PEXA acquisition is removed.

An increasing volume of $100m+ deals also suggests an increasing number of

unicorns emerging on our shores. We look forward to this trend continuing

in Australia, as high-profile success stories will attract more investors

to the venture capital and angel investment asset classes.

On a per capita basis, Victoria had a strong FY19 ($352) but experienced

minimal growth into FY20 ($356) while NSW grew strongly (up 115%) from FY19

($229) while NSW fared better in FY20 ($492). In both cases fintech

megadeals drove the high funding levels.

In Australia, funding of local startups sits around $271 per capita per

annum. This takes an all-sources view of funding, and includes VC, angel,

acquisitions, public markets and grants. Narrowing the view to only include

private funding of startups, the figure is closer to $121 per capita. This

compares to $604 in Israel and $412 in the US according to data published

by StartupGenome.

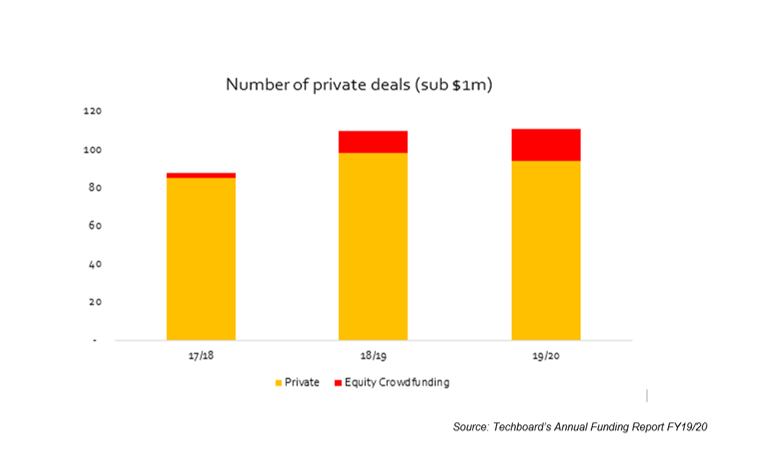

Late last year StartupAUS’s Crossroads Report reported a worrying trend in

angel and seed funding, with a continued decline in number of deals

recorded from FY17 to FY19. This was based on data recorded by US-based

data provider Pitchbook. Techboard data, which includes exclusive data

sourced directly from Australian angel groups, paints a less worrying

picture.

Private deals in the sub $1mn range have remained relatively stable over

the past three years at just under 100 per year, and would likely have

shown more of an increase in the last year were it not for the impact of

COVID-19. Data collected from the major angel groups shows total funds

deployed remained steady at circa $10 million in FY18 and FY19, but

increased to $14 million in FY20, despite a drop off in activity in the

last quarter following COVID-19.

Data on angel investment has been historically difficult to track because

many seed stage deals remain confidential. While many high-net-worths

invest independently, many angels join local angel groups in order to

benefit from increased deal flow and peer support. As such, angel groups

can provide some insight into the overall activity level of the asset

class.

Click here to read the full report.

About Techboard.com.au

Techboard, founded by Peter van Bruchem and Rafael Kimberley-Bowen has been

tracking funding of Australian Startups and Young Technology Companies

since 2017. Itis a leading source for up-to-date data on the Australian

startup and young technology company ecosystem. Techboard maintains three

interlinked datasets which include a directory of more than 3,800

Australian startups and young technology companies, comprehensive funding

and deal data and an Investor/funder dataset.

Techboard publishes free reports containing high level insights and

provides subscription access to its company, deal and investor data and a

recently updated platform and Funding Event Search Engine.